The Income Statement

Published: FinanceThe income statement, also known as a profit and loss statement (P&L), is a crucial financial document that provides a summary of a company's revenues, expenses, and profits or losses over a specific period. It is one of the three primary financial statements used by businesses, alongside the balance sheet and cash flow statement. This article delves into the components, importance, and interpretation of income statements.

Components of an Income Statement

Revenue (Sales): This is the total amount of money a company earns from its business activities, such as the sale of goods or services. Revenue is typically listed at the top of the income statement and is crucial for assessing a company's ability to generate income.

Cost of Goods Sold (COGS): COGS represents the direct costs attributable to the production of goods sold by a company. It includes the cost of raw materials, labor, and overhead costs directly associated with production.

Gross Profit: This is calculated by subtracting COGS from revenue. Gross profit indicates how much money a company makes after accounting for the costs directly related to producing its products or services.

Operating Expenses (OPEX): These are the costs associated with running a business on a day-to-day basis, excluding COGS. Examples include rent, utilities, salaries, marketing, and administrative expenses.

Operating Income: Also known as EBIT (Earnings Before Interest and Taxes), this is calculated by subtracting operating expenses from gross profit. It represents a company's profitability from its core operations.

Non-Operating Income and Expenses: These are revenues and expenses not directly related to a company's primary operations, such as interest income, investment gains, and one-time charges.

Pre-Tax Income: This is calculated by adding non-operating income and subtracting non-operating expenses from operating income. It represents a company's earnings before taxes.

Net Income (Profit): This is the final line on the income statement, calculated by subtracting taxes from pre-tax income. It represents the company's earnings after all expenses, including taxes, have been accounted for.

Importance of Income Statements

Income statements are essential for several reasons:

Performance Assessment: They provide a clear picture of a company's financial performance over a specific period, helping stakeholders understand whether the company is profitable or not.

Decision Making: Management uses income statements to make informed decisions about pricing, cost control, and investment strategies.

Investor Attraction: Potential investors and lenders review income statements to assess a company's financial health and potential for growth.

Comparative Analysis: Income statements allow for comparison across different periods (horizontal analysis) or with industry benchmarks (vertical analysis), helping to identify trends and areas for improvement.

Compliance: Publicly traded companies are required to publish income statements to comply with regulatory requirements and provide transparency to shareholders.

Interpreting Income Statements

When analyzing an income statement, it is crucial to consider several factors:

Revenue Growth: Consistent revenue growth indicates a healthy, expanding business. However, it should be analyzed alongside other metrics to ensure it is sustainable.

Profit Margins: Gross, operating, and net profit margins provide insights into a company's efficiency and profitability. Higher margins generally indicate better financial health.

Operating Expenses: High operating expenses relative to revenue may signal inefficiencies or excessive spending, which could impact profitability.

Non-Operating Items: Significant non-operating income or expenses can distort a company's true operational performance, so they should be examined carefully.

Trends and Patterns: Analyzing income statements over multiple periods can reveal trends, such as increasing or decreasing profitability, which can inform strategic decisions.

Resources

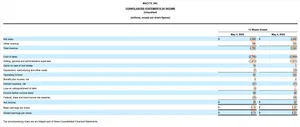

You can find examples of financial statements to look at and practice analyzing for a variety of companies using the EDGAR Search Area of the SEC website. For example, let's take a look at Macy's Quartery Income Statement that can be found there: Macy's, Inc. Consolidated Statements of Income.

What Does The Macy's Income Statement Tell Us?

Revenue Performance

- Net Sales declined from $4.846B (2024) to $4.599B (2025) — a decrease of $247M or 5.1%.

- Other Revenue increased from $154M to $194M — a $40M or 26% increase.

- Total Revenue fell from $5.000B to $4.793B, a 4.1% drop.

Interpretation: Macy's saw a modest increase in other revenue but a notable drop in core net sales, indicating weaker consumer demand or store performance.

Expenses and Operating Income

- Cost of Sales decreased from $2.946B to $2.795B, a 5.1% reduction.

- SG&A Expenses stayed relatively flat ($1.911B vs $1.913B).

- Operating Income dropped from $125M to $94M, a 24.8% decline.

Interpretation: Macy’s managed cost of sales effectively, but the flat SG&A coupled with declining revenue squeezed operating income.

Other Income/Expense

- Interest Expense decreased slightly from $31M to $27M.

- Impairments and Restructuring Costs were lower in 2025 ($7M) vs. 2024 ($19M).

- Gains on Sale of Real Estate improved significantly from $1M to $16M.

Interpretation: Lower restructuring costs and one-time gains helped partially offset revenue and operating income declines.

Bottom Line About Macy's

- Income Before Taxes dropped from $98M to $68M, a 30.6% decrease.

- Tax Expense remained constant at $30M.

- Net Income fell from $62M to $38M, a 38.7% drop.

Earnings Per Share (EPS):

- Basic EPS dropped from $0.22 to $0.14

- Diluted EPS dropped from $0.22 to $0.13

Overall Evaluation

- Macy’s experienced weaker top-line growth and a significant drop in profitability.

- Despite cost containment efforts and non-operating income boosts (real estate sales), core operating performance deteriorated.

- Net income and EPS declined nearly 40%, which is a material concern for investors.

Macy’s Q1 2025 performance indicates challenges in revenue generation and profitability, despite some bright spots in cost control and one-time gains. Sustained focus will be needed on boosting core sales and improving operational efficiency to reverse this trend.

Take a Look at Other Income Statements to Practice

Find income statements for companies that interest you and try to do a similar evaluation as what was done above for Macy's. It will help you learn to excel in reading and interpreting them!

Conclusion

Income statements are vital tools for understanding a company's financial performance and health. By providing a detailed breakdown of revenues, expenses, and profits, they offer valuable insights to managers, investors, and other stakeholders. However, interpreting income statements requires a comprehensive understanding of their components and the ability to analyze trends and patterns. When used effectively, income statements can guide strategic decision-making and contribute to a company's long-term success.